The following list is based on average daily global oil production for all publicly traded companies during the most recent fiscal quarter. As noted in the article on natural gas producers, some of the largest producers in the world are either not publicly traded, are largely government owned, and/or they don’t regularly publish production data. Thus, some major producers are missing from this list, such as Saudi Aramco (not yet publicly traded) and Russia’s Lukoil (no production data for the most recent fiscal quarter).

With those caveats in mind, here are the Top 10 current publicly traded oil producers:

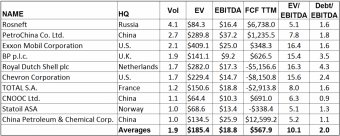

The Russian giant Rosneft leads all other producers by far at 4.1 million bpd of oil production, while the top U.S.-based company ExxonMobil was far behind at 2.1 million bpd. However, ExxonMobil is also one of the world’s largest natural gas producers, and has the highest market value of any company in this list.

In total, this Top 10 represents about 20% of global oil production. The list is geographically diverse, but China’s three companies cumulatively have the most production at 4.7 million bpd (and this accounts for nearly all of China’s production).

To put these giants in perspective, the previous list of U.S.-based pure oil and gas producers had Conoco Phillips in the top spot, but its 756,000 bpd of oil production in the most recent fiscal quarter would have landed it in 12th place on this list.

Although four of the companies on the list have generated negative free cash flow for the past year, in general the group’s financial metrics are sound. None of these companies are likely to find themselves in serious financial trouble any time soon, although BP and Shell both could stand to reduce some debt. It goes without saying that I make no investment recommendations based on this list. Financial metrics can differ for many reasons, and investments in different countries have differing levels of risk.

Source: forbes.com