Crude oil prices eased to around $45 per barrel in August as a global supply overhang weighed and demand growth weakened, the newly released IEA Oil Market Report (OMR) for August informs subscribers. Brent crude had threatened to break below $40 per barrel at the end of July.

Crude oil prices eased to around $45 per barrel in August as a global supply overhang weighed and demand growth weakened, the newly released IEA Oil Market Report (OMR) for August informs subscribers. Brent crude had threatened to break below $40 per barrel at the end of July.

Global oil demand growth is expected to slow from 1.4 mb/d in 2016 to 1.2 mb/d in 2017, as underlying support from low oil prices wanes. The 2017 forecast – though still above-trend – is 0.1 mb/d below our previous expectations due to a dimmer macroeconomic outlook. The 2016 outlook is unchanged from last month’s Report.

Meanwhile global oil supply rose by about 0.8 mb/d in July, as both OPEC and non-OPEC production increased. Output was 215 kb/d lower than a year earlier, as declines from non-OPEC more than offset an 840 kb/d annual gain in total OPEC liquids. Non-OPEC production is forecast to drop by 0.9 mb/d this year before rebounding by 0.3 mb/d in 2017.

OPEC crude oil output rose by 150 kb/d to 33.39 mb/d in July as Saudi Arabia pushed output to the highest ever and Iraq pumped more. Robust Middle East production lifted total OPEC crude supply 680 kb/d above a year ago and held output at an eight-year high.

Global refinery throughput in the third quarter is expected to rise by 2.2 mb/d from a weak second quarter to a record 80.6 mb/d. At only 0.6 mb/d above a year earlier, third quarter runs will lag expected demand growth, eroding some of the product stock cushion built up since mid-2015. Runs are forecast to decline seasonally to below 80 mb/d in the fourth quarter of 2016.

An OECD inventory overhang continued to shift from crude into products during June, with commercial stocks swelling by 5.7 mb to a record 3 093 mb. Declines in crude oil holdings were offset by an above average product build of 15.9 mb, with big volumes of US propane and other NGLs moving into storage.

Source: iea.org

Reflecting the IEA’s increasingly global perspective, for the first time the Agency’s OECD and non-OECD Energy Balances and Statistics reports have been merged into two comprehensive global reports on energy data. World energy Balances and World Energy Statistics will contain detailed data on over 150 countries and regions and will be released in full at the end of August 2016.

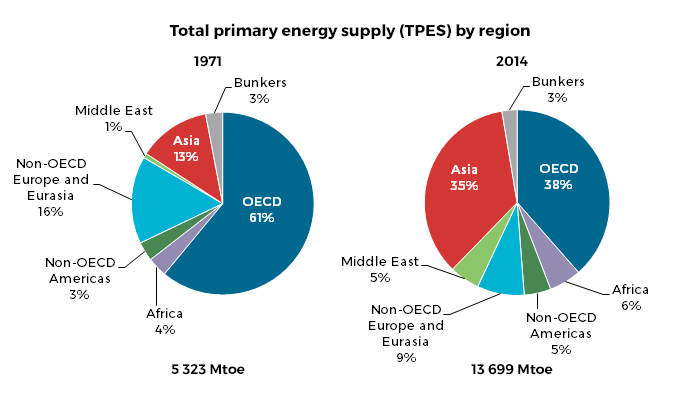

Reflecting the IEA’s increasingly global perspective, for the first time the Agency’s OECD and non-OECD Energy Balances and Statistics reports have been merged into two comprehensive global reports on energy data. World energy Balances and World Energy Statistics will contain detailed data on over 150 countries and regions and will be released in full at the end of August 2016. The reports also highlight the significant changes in regional energy demand that have taken place over the past 40 years. In 1971 OECD (including Japan and Korea) and the rest of Asia (including China) together accounted for almost three quarters of energy usage, with OECD demand four times greater than that of Asia. Yet while the combined energy share of these regions remained at around three quarters of the global total in 2014, the proportions changed drastically; OECD and Asia became broadly comparable, at 38% and 35% respectively.

The reports also highlight the significant changes in regional energy demand that have taken place over the past 40 years. In 1971 OECD (including Japan and Korea) and the rest of Asia (including China) together accounted for almost three quarters of energy usage, with OECD demand four times greater than that of Asia. Yet while the combined energy share of these regions remained at around three quarters of the global total in 2014, the proportions changed drastically; OECD and Asia became broadly comparable, at 38% and 35% respectively.

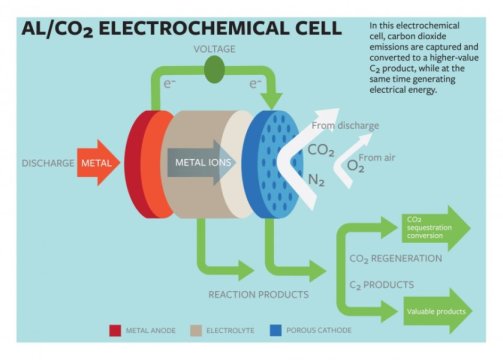

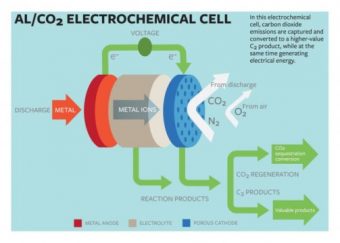

While the human race will always leave its carbon footprint on the Earth, it must continue to find ways to lessen the impact of its fossil fuel consumption.

While the human race will always leave its carbon footprint on the Earth, it must continue to find ways to lessen the impact of its fossil fuel consumption.

The United Kingdom, followed by Australia and the Republic of Korea, lead the world in providing government services and information through the Internet, according to a new survey released on 1st August by the United Nations showing the progress of nations in promoting e-government.

The United Kingdom, followed by Australia and the Republic of Korea, lead the world in providing government services and information through the Internet, according to a new survey released on 1st August by the United Nations showing the progress of nations in promoting e-government. The United Nations Industrial Development Organization (UNIDO) and the International Centre for Integrated Mountain Development (ICIMOD), with financial support from the Austrian Development Agency, are preparing to establish a Himalayan Centre for Renewable Energy and Energy Efficiency.

The United Nations Industrial Development Organization (UNIDO) and the International Centre for Integrated Mountain Development (ICIMOD), with financial support from the Austrian Development Agency, are preparing to establish a Himalayan Centre for Renewable Energy and Energy Efficiency.