Renewable energy solutions are often hindered by the inconsistencies of power produced by wind, water and sunlight and the continuously fluctuating demand for energy. New research by Mark Z. Jacobson, a professor of civil and environmental engineering at Stanford University, and colleagues at the University of California, Berkeley, and Aalborg University in Denmark finds several solutions to making clean, renewable energy reliable enough to power at least 139 countries.

In their paper, published as a manuscript this week in Renewable Energy, the researchers propose three different methods of providing consistent power among all energy sectors—transportation; heating and cooling; industry; and agriculture, forestry and fishing—in 20 world regions encompassing 139 countries after all sectors have been converted to 100 percent clean, renewable energy. Jacobson and colleagues previously developed roadmaps for transitioning 139 countries to 100 percent clean, renewable energy by 2050 with 80 percent of that transition completed by 2030. The present study examines ways to keep the grid stable with these roadmaps.

“Based on these results, I can more confidently state that there is no technical or economic barrier to transitioning the entire world to 100 percent clean, renewable energy with a stable electric grid at low cost,” said Jacobson, who is also a senior fellow at the Stanford Precourt Institute for Energy and the Stanford Woods Institute for the Environment. “This solution would go a long way toward eliminating global warming and the 4 million to 7 million air pollution-related deaths that occur worldwide each year, while also providing energy security.”

The paper builds on a previous 2015 study by Jacobson and colleagues that examined the ability of the grid to stay stable in the 48 contiguous United States. That study only included one scenario for how to achieve the goals. Some criticized that paper for relying too heavily on adding turbines to existing hydroelectric dams—which the group suggested in order to increase peak electricity production without changing the number or size of the dams. The previous paper was also criticized for relying too much on storing excess energy in water, ice and underground rocks. The solutions in the current paper address these criticisms by suggesting several different solutions for stabilizing energy produced with 100 percent clean, renewable sources, including solutions with no added hydropower turbines and no storage in water, ice or rocks.

“Our main result is that there are multiple solutions to the problem,” said Jacobson. “This is important because the greatest barrier to the large-scale implementation of clean renewable energy is people’s perception that it’s too hard to keep the lights on with random wind and solar output.”

At the heart of this study is the need to match energy supplied by wind, water and solar power and storage with what the researchers predict demand to be in 2050. To do this, they grouped 139 countries—for which they created energy roadmaps in a previous study—into 20 regions based on geographic proximity and some geopolitical concerns. Unlike the previous 139-country study, which matched energy supply with annual-average demand, the present study matches supply and demand in 30-second increments for five years (2050-2054) to account for the variability in wind and solar power as well as the variability in demand over hours and seasons.

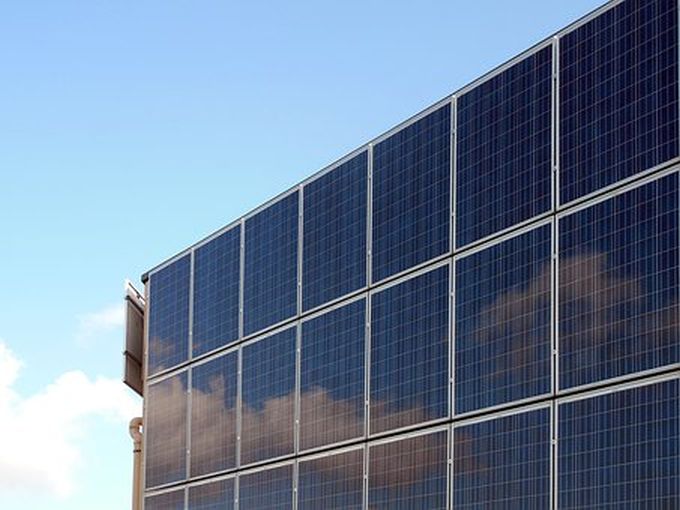

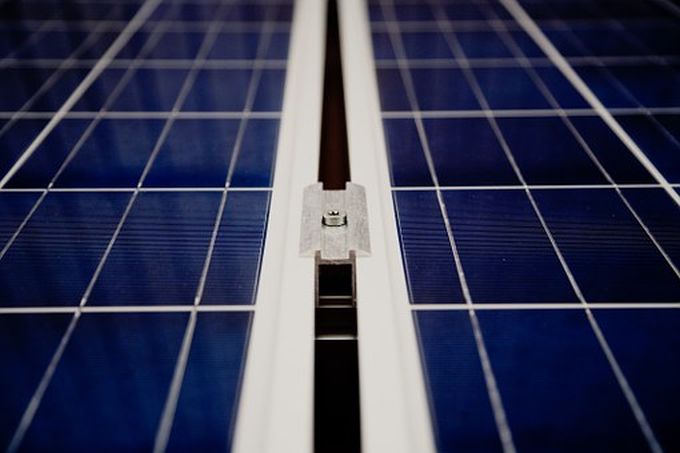

For the study, the researchers relied on two computational modeling programs. The first program predicted global weather patterns from 2050 to 2054. From this, they further predicted the amount of energy that could be produced from weather-related energy sources like onshore and offshore wind turbines, solar photovoltaics on rooftops and in power plants, concentrated solar power plants and solar thermal plants over time. These types of energy sources are variable and don’t necessarily produce energy when demand is highest.

The group then combined data from the first model with a second model that incorporated energy produced by more stable sources of electricity, like geothermal power plants, tidal and wave devices, and hydroelectric power plants, and of heat, like geothermal reservoirs. The second model also included ways of storing energy when there was excess, such as in electricity, heat, cold and hydrogen storage. Further, the model included predictions of energy demand over time.

With the two models, the group was able to predict both how much energy could be produced through more variable sources of energy, and how well other sources could balance out the fluctuating energy to meet demands.

Scenarios based on the modeling data avoided blackouts at low cost in all 20 world regions for all five years examined and under three different storage scenarios. One scenario includes heat pumps—which are used in place of combustion-based heaters and coolers—but no hot or cold energy storage; two add no hydropower turbines to existing hydropower dams; and one has no battery storage. The fact that no blackouts occurred under three different scenarios suggests that many possible solutions to grid stability with 100 percent wind, water and solar power are possible, a conclusion that contradicts previous claims that the grid cannot stay stable with such high penetrations of just renewables.

Overall, the researchers found that the cost per unit of energy—including the cost in terms of health, climate and energy—in every scenario was about one quarter what it would be if the world continues on its current energy path. This is largely due to eliminating the health and climate costs of fossil fuels. Also, by reducing water vapor, the wind turbines included in the roadmaps would offset about 3 percent of global warming to date.

Although the cost of producing a unit of energy is similar in the roadmap scenarios and the non-intervention scenario, the researchers found that the roadmaps roughly cut in half the amount of energy needed in the system. So, consumers would actually pay less. The vast amount of these energy savings comes from avoiding the energy needed to mine, transport and refine fossil fuels, converting from combustion to direct electricity, and using heat pumps instead of conventional heaters and air conditioners.

“One of the biggest challenges facing energy systems based entirely on clean, zero-emission wind, water and solar power is to match supply and demand with near-perfect reliability at reasonable cost,” said Mark Delucchi, co-author of the paper and a research scientist at the University of California, Berkeley. “Our work shows that this can be accomplished, in almost all countries of the world, with established technologies.”

Jacobson and his colleagues said that a remaining challenge of implementing their roadmaps is that they require coordination across political boundaries.

“Ideally, you’d have cooperation in deciding where you’re going to put the wind farms, where you’re going to put the solar panels, where you’re going to put the battery storage,” said Jacobson. “The whole system is most efficient when it is planned ahead of time as opposed to done one piece at a time.”

In light of this geopolitical complication, they are also working on smaller roadmaps to help individual towns, many of which have already committed to achieving 100 percent renewable energy.

Source: ecowatch.com

Our interlocutor is Ph.D. Aleksandar Joksimovic, the Head of the Laboratory for ichthyology and coastal fishery in this Institute. Mr. Joksimovic received a doctorate at the Faculty of Biology of the University of Belgrade. His doctoral dissertation was about ‘’Fishery Biology and population dynamics of some economically important fish species of the Montenegrin coast’’, and he is also the main negotiator of Montenegro for the opening of negotiation Chapter 13 (Fisheries) of the EU as well as the scientifically responsible person on behalf of Montenegro at the General Fisheries Commission for the

Our interlocutor is Ph.D. Aleksandar Joksimovic, the Head of the Laboratory for ichthyology and coastal fishery in this Institute. Mr. Joksimovic received a doctorate at the Faculty of Biology of the University of Belgrade. His doctoral dissertation was about ‘’Fishery Biology and population dynamics of some economically important fish species of the Montenegrin coast’’, and he is also the main negotiator of Montenegro for the opening of negotiation Chapter 13 (Fisheries) of the EU as well as the scientifically responsible person on behalf of Montenegro at the General Fisheries Commission for the

This summer, within the framework of the project implemented by the Bio-ICT Centre for Excellence, in partnership with the Public Enterprise for coastal zone management, and the company “APLITUDO” from Podgorica, smart buoys were installed, on several locations in the open sea and one in the Bay of Kotor, which are powered by solar energy and are used to measure the salinity, temperature and pH of the water. The measured data are sent to the base of the site using GPRS. As this is a pilot project, we are working on a model for the data to be available for interested individuals and companies, through registration and subscription, and in the future, this concept could become an open data form, with the extension of the monitored parameters.

This summer, within the framework of the project implemented by the Bio-ICT Centre for Excellence, in partnership with the Public Enterprise for coastal zone management, and the company “APLITUDO” from Podgorica, smart buoys were installed, on several locations in the open sea and one in the Bay of Kotor, which are powered by solar energy and are used to measure the salinity, temperature and pH of the water. The measured data are sent to the base of the site using GPRS. As this is a pilot project, we are working on a model for the data to be available for interested individuals and companies, through registration and subscription, and in the future, this concept could become an open data form, with the extension of the monitored parameters.