The professional Jury of Novi Sad fair declared this year ProCredit Bank as the best bank in agribusiness standing commitment of this financial institution to support domestic agricultural producers who persistently and patiently develop their business. With Ivan Smiljković, a member of the Executive Board at ProCredit Bank, we discussed a trend of growing interest in credit lines among Serbian farmers and owners of small and medium-sized enterprises from numerous industrial sectors, as well as the interest of companies that produce or import equipment, seeds, intermediate goods and commercial vehicles in partner relationship with the bank in order to improve domestic economic development.

The professional Jury of Novi Sad fair declared this year ProCredit Bank as the best bank in agribusiness standing commitment of this financial institution to support domestic agricultural producers who persistently and patiently develop their business. With Ivan Smiljković, a member of the Executive Board at ProCredit Bank, we discussed a trend of growing interest in credit lines among Serbian farmers and owners of small and medium-sized enterprises from numerous industrial sectors, as well as the interest of companies that produce or import equipment, seeds, intermediate goods and commercial vehicles in partner relationship with the bank in order to improve domestic economic development.

EP: The data from your portfolio indicate that you have provided the largest financial support to farmers in the domestic banking market so far. How did you develop this business sector?

Ivan Smiljkovic: We have been actively supporting Serbian farmers for seventeen years, but this is not our only focus. Serbian agriculture is seen as an integral branch of the entire economy, so our goal is actually to develop small and medium business in Serbia by providing financial support to enterprises. When it comes to agriculture, we always work with our partners and we agree on conditions that can influence the growth of yield and income. We strive to provide facilities for the procurement of various type of equipment: process, production, and processing. Naturally, we help in the purchase of tractors, combines, and attachable machinery. On the basis of long-standing cooperation, suppliers of this equipment expect increased sales and are ready to reduce the price by paying part of the interest for agricultural producers. This is the biggest side benefit of our joint cooperation for both the end-user and the supplier. The number of our partners has expanded, but the world’s leading manufacturers of equipment and materials are in the lead position because they can guarantee quality, lower energy consumption per unit produced, which automatically means that the businessmen can have lower costs and greater competitiveness. Nevertheless, domestic companies which produce a lot of smaller agricultural machinery and reproductive material, as well as domestic seeds, are also involved. We also have construction companies that offer construction of agricultural facilities, such as storage silos.

EP: What is your assessment of the future of financing and development of the agricultural sector in our country?

Ivan Smiljkovic: In the previous period, we had the opportunity to see that the average agricultural holdings with ve to ten hectares of land reached the level of large producers with several hundred hectares, some even more than 1,000 hectares, which made them serious businessmen not only in our country but probably also in the region. The development of agriculture in Serbia takes place quite quickly, and we are quite different from other countries. Our participation in this advancement is great, but the entrepreneurial spirit of the farmers, as well as their desire to invest from a loan or reinvest from gained profit, is significant. Taking this into account, I can freely predict them bright future.

EP: Do you expect some other banks to provide more support to agribusiness?

Ivan Smiljkovic: Competition in agriculture loans is growing because, in the last year and a half, the number of banks that give loans to farmers has increased. Our advantage lies in the knowledge and expertise we have gained over the past seventeen years, as well as the commitment of management and employees to provide appropriate solutions for financing agriculture. This is not an additional segment of business for us, but it is strategically important, and we are dedicated to its progress through a comprehensive banking offer for small and medium business and agriculture. These two segments, agriculture and the development of small and medium-sized enterprises make up over 90 percent of our total placements and, thanks to that, we today hold a leadership position.

EP: Out of a total number of agricultural loans granted, almost every other is approved by your bank. What is the advantage of your offer to farmers?

Ivan Smiljkovic: We have business units that are solely dedicated to cooperation with agricultural producers and providing services in issuing agricultural loans. It is important to say that farmers need not only credit but also advice on how to manage nances, where to allocate surplus funds and what measures of credit support they need. It is obvious that we have raised our cooperation with individual producers to a higher and new level. Here is one example of this cooperation. Last year we organized, on the level of the entire ProCredit Group, an important meeting in Thessaloniki, attended by about 850 producers and businessmen from the region, not just farmers. In this forum, our businessmen could exchange experiences with other businesses with small or medium-sized enterprises in one place, as well as to find a new market for their products or to reach the supplier of equipment, seeds, and reproductive material. This is best seen in the long-term and consistent relationship of our bank towards clients.

“GREEN FUNDING” ProCredit Bank

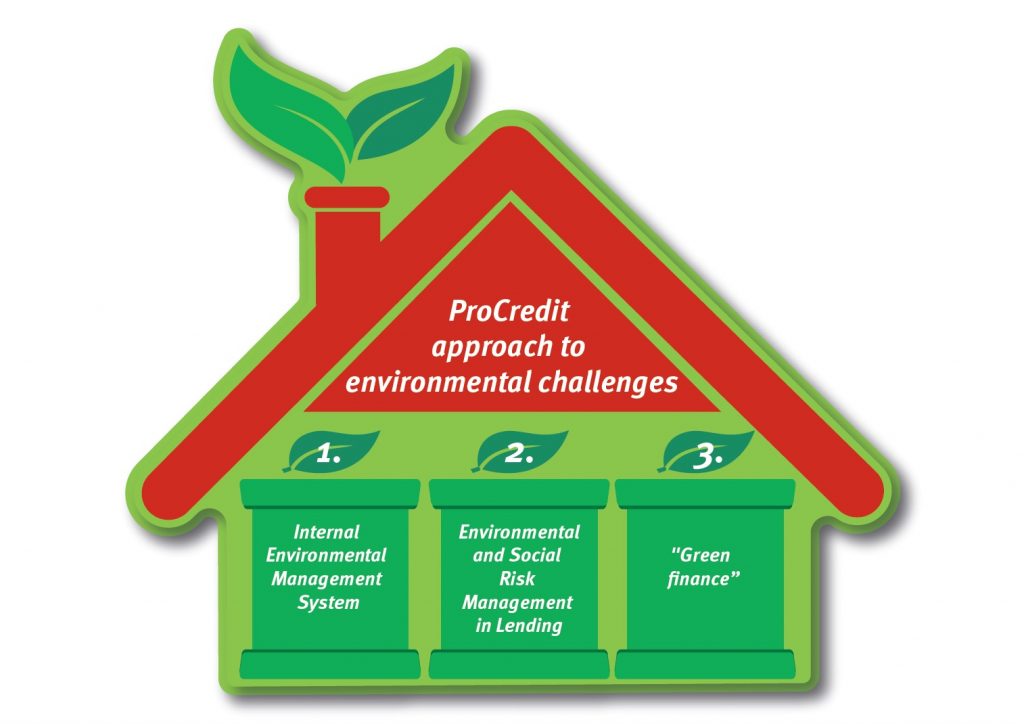

The commitment to protect the environment in ProCredit Bank is reflected in a concept based on three pillars of activity. “The first is an internal pillar which is dedicated to the continuous reduction of direct impacts that our bank and our business have on the environment. This is about the activities that we are trying to reduce our consumption of energy, water, paper and the like,” says Ivan Smiljkovic. The second pillar refers to risk management and the promotion of environmental standards when approving loans to clients. At the very end, the third pillar is green financing, which means that ProCredit Bank actively promotes and supports various types of investments in energy efficient projects, renewable energy sources and environmental protection solutions. “We are proud of the fact that in September this year the share of green loans exceeded 10 percent and the growth rate is more than 30 percent. This is the biggest growth of one sector. And our plans in this segment are very ambitious. This is one of the pillars we often say that it supports our basic strategy of investing in the development of small and medium-sized enterprises that have a green strategy, “says Ivan Smiljković, adding, ”We are a development-oriented commercial bank. Nevertheless, while we strive to help develop the domestic economy, we take care of preserving the environment for us and our children as well as for all future generations.”

EP: Agricultural loans with state subsidies have been reallocated this year, and ProCredit Bank mediated it between its clients and the Ministry of Agriculture in order to improve business in the agro sector with this support.

Ivan Smiljkovic: Every year our participation in the Ministry of Agriculture’s agriculture loan programs is about 50 percent. We provide funds, while the Ministry subsidizes interest. The procedure for obtaining subsidized loans is not so complicated, and for our farmers, perhaps the most important thing is our timely reaction and individual approach as well as the understanding of business models, which gives them security in obtaining loans. This year, support to the agricultural sector has been improved, so loans were granted to agricultural producers under 40 years old, as well as women in agriculture, and the interest rate was 1%. The speed of processing requests and understanding of needs are the most important factors that enable the producer to obtain this loan. Our role was also to actively inform the competent Ministry on the problems of farmers, and especially this year when droughts were expressed, in order to take these reasons into account when determining terms and deadlines for the loan.

EP: What are the basic conditions for crediting agricultural production?

Ivan Smiljkovic: First of all, there must be agricultural production, that is, a registered agricultural holding with a certain history of business, certain revenues, and a sustainable business. In order to ensure stability and predictability of development, as a bank, we have been financing our farmers for years to increase their estates. Over the past two years, we have pledged more than EUR 26 million for the purchase of land through long-term loans with a repayment period of over 10 years, which is in line with the time of their return on investment. Specific conditions for the loans depend on the agricultural sector.

Ivan Smiljkovic: First of all, there must be agricultural production, that is, a registered agricultural holding with a certain history of business, certain revenues, and a sustainable business. In order to ensure stability and predictability of development, as a bank, we have been financing our farmers for years to increase their estates. Over the past two years, we have pledged more than EUR 26 million for the purchase of land through long-term loans with a repayment period of over 10 years, which is in line with the time of their return on investment. Specific conditions for the loans depend on the agricultural sector.

Our attitude is that small and medium enterprises, as well as agriculture, are the pillars of Serbian economy development. Almost 90 percent of our total placements were for small and medium-sized enterprises. We are proud of the fact that today the total placements of small and medium-sized businesses exceed 500 million euros in our bank. I would like to emphasize that this is not only specific to ProCredit Bank in Serbia, but the support to small and medium business is the focus of the whole Procredit Group and that in the past period all banks within the group increase their participation in financing small and medium enterprises.

Ivan Smiljkovic states that ProCredit Bank promotes investments in renewable energy sources and energy efficiency in order to promote the development of domestic agriculture. “The new technology that domestic businessmen, through our loans, acquire to improve productivity but already imply a high degree of energy efficiency – less energy is consumed, and CO2 emissions are lower. Two years ago, we organized a seminar in Novi Sad on active investment in biogas plants. A year passed from the initial steps towards the installation of these plants and the implementation of the first one and this time was spent on obtaining permits and starting out of documentation, which required a lot of dedication and effort. Today, the number of farmers interested in investing in renewable energy sources, and above all in biogas, is increasing. One of our projects is also a solar irrigation pump. Our partners and we have made the first such pump, which should primarily help vegetable growers irrigate their plants without the active participation of electricity or oil. We also tried to offer this product to our customers, but the response was not great due to low electricity prices. Nevertheless, I believe that greater interest in this investment will follow in the coming period”.

EP: What is the InnovFin Guarantee Scheme with which loans from the European Investment fund can be obtained?

Ivan Smiljkovic: We finance our portfolio partly from the credit lines we receive from international financial institutions, but mostly for the financing of our placements we rely on deposits that we have collected from the population and the economy. In our bank, one of the most attractive savings offers with very good interest rate is current at the moment and it is intended primarily for individuals. This means that all clients who leave a deposit in ProCredit Bank indirectly contribute to the faster development of domestic agriculture and small and medium-sized enterprises. Here, I would like to point out that as a responsible financial institution, we are directing our attention entirely to what contributes to the development of the domestic economy, and it is a guarantee for our depositors that we will use the entrusted funds for the best possible purpose.

On the other hand, the European Investment Fund allocated EUR 160 million through ProCredit to Serbia through the InnovFin program, and at the level of ProCredit Group, 850 million was approved for countries in South East Europe in which ProCredit Group is represented. This is an excellent guarantee scheme that has been prepared within the Horizon 2020 program to improve the competitiveness of the economy in Europe, and by introducing innovations in production, marketing and other areas in the small and medium business sector. Interest rates today are at the lowest historical level in Europe and Serbia, and we do not expect them to change drastically. Therefore, interest is no longer an insurmountable problem in financing. The biggest obstacle to financing encountered by owners of small and medium-sized enterprises is their inability to provide guarantees for long-term loans, despite having good ideas. InnovFin, which guarantees 50 percent of the placements, assists here.

In March 2016, we began to use the funds from this program, and by the end of September 2017, we financed over 62 million euros of investments that brought some kind of innovation to small and medium-sized enterprises. Another program that we also use is the Western Balkans Enterprise Development & Innovation Facility, also intended for small and medium businesses, which provides 70 percent coverage. In March this year we got 25 million euros and by September we used them. Through these two programs, we enabled our businessmen the access to funds of around EUR 90 million for a year and a half, which they used to improve their business processes and, therefore, their competitiveness on the domestic and foreign markets has increased significantly.

EP: Some time ago you held a seminar on energy saving through investing in energy efficient solutions in domestic companies. Then you presented the results ProCredit achieved by investing in energy efficiency measures in its branches. What are the results of these investments?

Ivan Smiljkovic: ProCredit has been taking care of energy consumption, CO2 emissions and the use of natural resources as well as recycling for years. We are the only financial institution with ISO standard 14001:2015 that we introduced last year together with all members of ProCredit Group. We focused mostly on building energy efficiency 19 measures, we developed a manual on how to equip our buildings, which includes all the elements – from insulation and heating to the monitoring system. We already have 100 percent of LED lighting in all of our business units. In almost all buildings, we have building management systems (BMS) with remote control, which help reduce energy consumption. I will use one example to see the savings. The heating energy we spent in the period from 2011 to 2016 decreased by 71 percent and the total energy by 38 percent.

We should not forget that we are also the first financial institution and company in Serbia that imported a fleet of electric cars. For the past year and a half, we have been using seven Volkswagen e-ups for our regular activities. Our long-term goal is to increase our fleet not only to electric but also to hybrid cars. So it was natural to invest in electric car chargers. Each of our branches has a built-in charger, and in the head office, we installed the first solar-powered charger this year. The energy mix in our country is primarily based on coal, and since we have decided to use electric cars powered by coal-based electricity, our impact on CO2 reduction would not be significant if we did not launch solar-charging projects. We are currently considering the possibility of installing a solar power plant on the roof of our building to produce electricity for your own needs. The process of collecting bids is underway and in the first quarter of 2018, we will be dedicated to the realization of this project.

Interview by: Tamara Zjacic

This interview was originally published in the ninth issue of the Energy Portal Magazine, named ECOHEALTH.