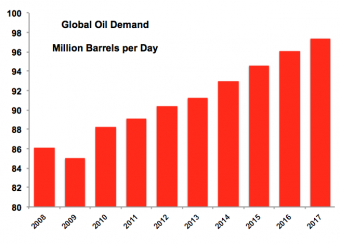

While incremental annual gains obviously vary, there is nothing more assured than increasing global oil demand. The steady drumbeat of more people, making more money, using more oil may be boring to some, but it is also perhaps our most fundamental energy reality. The world now consumes ~95 million b/d of oil, up from 86 million b/d in 2008 and a 11% rise even amid the worst economic times since the 1930s.

While incremental annual gains obviously vary, there is nothing more assured than increasing global oil demand. The steady drumbeat of more people, making more money, using more oil may be boring to some, but it is also perhaps our most fundamental energy reality. The world now consumes ~95 million b/d of oil, up from 86 million b/d in 2008 and a 11% rise even amid the worst economic times since the 1930s.

And we know that there is so much more to come: oil is the world’s primary fuel, oil is the enabling force of globalization, and 85% of the global population lives in undeveloped nations still waiting for their chance to consume oil like we rich Westerners do. Just imagine the future: every day, for instance, the average American consumes 25 times more oil than the average Indian, and India has four times more people!

But even idiosyncratic factors that don’t immediately come to mind can quickly boom demand in a very short period of time. For example, over the past year or so, China has been filling its strategic petroleum reserves as prices plunged. EIA estimates that China is planning to build 500 million barrels of strategic crude oil reserve space by 2020. No wonder: the Chinese now buy nearly 25 million oil-based cars a year.

Even the developed nations with saturated markets are by no means facing “declining oil demand,” regardless of what you keep hearing. U.S. oil demand won’t dip below 19.3 million b/d for as far as models are forecasting, and even environmental stalwart Europe is set for an increase in oil demand (here). This comes from the ignored fact that oil has no significant direct substitute. No matter the attention they receive or the incentives being offered, non-oil vehicles, for instance, are not even 1% of the vehicles being sold.

Even the developed nations with saturated markets are by no means facing “declining oil demand,” regardless of what you keep hearing. U.S. oil demand won’t dip below 19.3 million b/d for as far as models are forecasting, and even environmental stalwart Europe is set for an increase in oil demand (here). This comes from the ignored fact that oil has no significant direct substitute. No matter the attention they receive or the incentives being offered, non-oil vehicles, for instance, are not even 1% of the vehicles being sold.

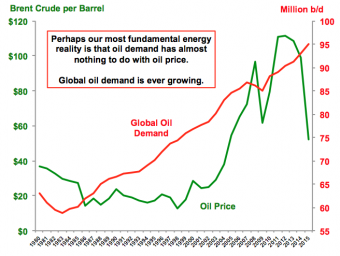

This indicates why the demand for oil is largely inelastic with respect to price. Whether oil prices rise or fall, demand continues to mount in a staggeringly similar manner . That’s because oil demand is far more related to the general constants of rising economic growth and personal income than it is to price .

And with 20,000 children a day dying from preventable poverty enabled by a lack of energy, the rich West has the moral obligation to encourage massive economic growth for the world’s poor. Nations with higher incomes have a higher standard of living and live healthier, longer lives. It’s those countries that don’t consume much oil that suffer most and remain isolated from the rest of the world.

Thus, policies that hurt the U.S. oil industry in the name of helping Americans are sheer folly because they ultimately just hurt Americans by making an indispensable product more difficult and costly to bring to market. Especially since oil is a global commodity sold on an international market, where “events over there affect prices over here,” rising oil demand mandates that we produce as much here and support our oil industry as much as possible.

Because if we don’t, if we just leave the supply and production chain to Russia and OPEC, global and U.S. oil security will be severely eroded, and we will be at the whim of people that “don’t like you very much.”

Source: forbes.com