Google plans to build a new data center in the city of Pine Island, in the U.S. state of Minnesota, which will be powered by electricity from new renewable energy sources.

In addition, the project includes the installation of an iron-air battery (batteries based on iron and air) with a capacity of 30 GWh and a power output of 300 MW, currently the largest battery system in the world in terms of gigawatt-hour capacity. The batteries are developed and manufactured by the U.S. company Form Energy, and the system will be able to store energy for up to 100 hours.

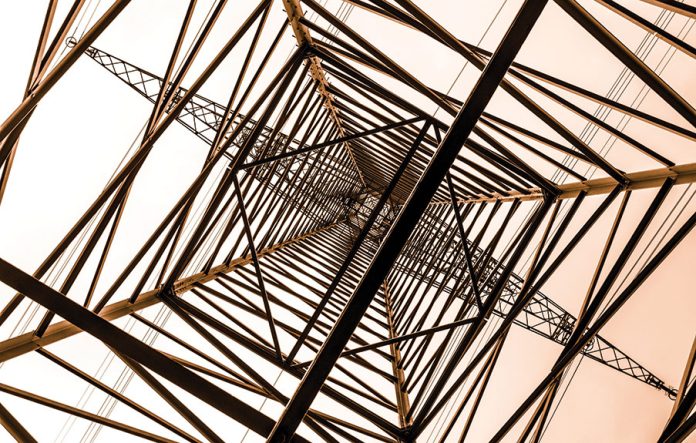

According to the U.S. energy company Xcel Energy, with which Google has signed a power supply agreement for the new data center, the project will include 1,400 MW of wind turbines, 200 MW of solar panels, and 300 MW of long-duration energy storage. Google will cover all costs for the new grid infrastructure, so existing Xcel Energy customers will not see their bills increase.

More:

- Global AI and Energy Monitoring Center: IEA Announces Innovations as India Builds the World’s Largest Data Center

- Google Publishes First Detailed Report on Energy Consumption of Its AI Applications

This project is one of the largest in the field of long-duration energy storage and significantly contributes to the goals of the state of Minnesota to increase the share of electricity generated without carbon dioxide emissions.

Data centers are a key part of the digital economy infrastructure, as they support services used daily by billions of people, including YouTube, Google Maps, the Google Search engine, and Google Workspace.

Energy Portal